Tuesday, December 22, 2009

32 OPT-Ag DEC 2009 SAMPLE BY GEOLOGIST MINE No 4

Thursday, December 10, 2009

I. More Assay Results II. Offer Amendments

The owner of the mine desires to maintain a 20% ownership in the mine so as to receive partnership profit benefits for operating the mine, since he believes the mine is one of the last unexplored bonanzas in Nevada. We invite you to study the exploration and historical data. The following are some of the highlights.

I. Significant Assay Results in Mine or Adjacent Property

(an indicator of potential for the deeper high grade vein zone)

Lode Samples of Gold and Silver in opt (ounces per ton grading of samples by assay).

Atomic Chart symbols for Gold is “Au” and Silver is “Ag”.

3.8 opt Au and 150 opt Ag on the stonewall of GSHG Lode, pg 3i

- photo of this sample is in Prospectus video #1.

1.5 opt Au and 179 opt Ag in the P claim in east quadrant of the sulfide silver-gold anomaly is bordered by a black Triassic limestone outcropping unit. Samples of the limestone carry gold in excess of 0.1 opt with silver values. This silver-gold anomaly lies between these two units. A complete drill program of this area will increase grade and content, adding to overall resource of the Mine Property, pg 3i - photo of this sample is in Prospectus video #1.

This is the last sample in Prospectus video #1

0.2 opt Au and 0.3 opt Ag ID: Lode Quartz found at apex of lode and prospects below the Mine. the neighborhood, pg 13a. Apex of Lode is in the Mine Property.

Rock specimen in workbook containing;

2.3 opt Au and 180 opt Ag ID: Quartz var. Pyrargyrite, Claim due south of Mine, pg 15

Rock specimen in workbook containing;

3.5 opt Au and 230 opt Ag ID: Quartz var. Argentite from Silver Lode Mine in the neighborhood, pg 15

0.2 opt Au and 0.2 opt Ag assay samples of quartz outcropping in the Mine Property. Refer to Geological Map at end of video depicting a “high grade fissure”, the one zone in red color, indicating a Gold-Silver High Grade (GSHG) Vein type lode for a distance of at least 2,000 feet long by approx 100 feet wide running through several mining properties with historic production results. GSHG vein is a quartz lode structure that is “chimney pipe-like” rising from depths to the surface formed as an up-thrust between Triassic era limestone and Tertiary Volcanic units. This structure forms the apex of the GSHG Lode and is in the property of the Mine. The mineralogy of the ore zone is made of silver and gold sulfides with native gold and silver values in a sulfide quartz ore matrix – page 6.

Another geology map illustrates the GSHG vein in yellow color as a gold reserve of 159,000 oz Au down to a depth of 450 feet as an amorphous body at least 2,000 feet long by approx 100 feet wide to the northwest and widens to 700 feet wide towards the southeast resembling shapes like upside-down branches of a tree/ moose antlers in the area of the Mine Property. (Why SELR wants to start there. SELR is a big giver.) Jasperoid outcrops seem to define the structural pattern. Alteration and mineralization phases like silicification, decalcification and advance argillization with pronounced oxidation and leaching points to an epithermal system substantiated by hydrothermal alteration textures and brecciation – page 3.

The disseminated deposit on the property is with rhyolite tuff beds and meta-sediment underlain by greenstone.

The areas of historic operation have not exhausted the mineralization. The apex of the lode rises to the surface in the Mine Property for sale down to depths ranging from 450 ft to 620 ft (pause the video when at the Section drawing). Historic production occurred in two eras: 1860 – 1880 and 1920s.

An adit was developed for the underground exploration-development effort of the mineralized gold/silver trend to intercept .3 opt Au and 10 opt Ag. It is believed, based upon anomaly field studies and sampling/drilling, that the quartz lode is a continuation of the GSHG mineralized trend, south central part of the overall seventeen (17) mile trend predominantly in a small mountain range and portions of trend continue under alluvial fans splaying out into adjacent prairie, refer to video #2 for geography of the vicinity containing rounded hills covered with juniper forest connecting occasional mountains approx 4 to 5 miles apart bounded by large, low angle continuous strips of alluvial fan bordering chaparral prairie and range land . That summary is from the 2008-2009 N-NW quadrant development project by the Owner’s Mining Company (OMCo), pg 3h.

Lode Samples for Gold by Exploratory Drilling

0.615 opt Au, ID: Quartz Lode 029742-FA30, Oct 09, 2002, pg 13b

0.620 opt Au, ID: Quartz Lode 029742-FA30{R}, Oct 09, 2002, pg 13b

0.201 opt Au, ID: Marked Sample, Oct 30, 2002, pg 13b

0.1-0.3 opt Au Ls. Outcrops of ore, 2003-2004 Ore N&NE Expansion Project, pg 7

0.1-0.2 opt Au Quartz Outcrops, 2003-2004 Ore N&NE Expansion Project, pg 7

0.134 opt Au, 5 ft interval: 135 - 140 ft, ID: RC Hole 007 in 1984, pg 3a

In Prospectus video #1 are two 3-D color rendered cross section models representing two ore bodies and topography, sediment/volcanic contact, bounding fault and 0.01 opt gold grade envelope.

Two ore bodies

Upper Zone in yellow – disseminated lode extraction by open pit with heap leach

Lower Zone in blue – gold-silver high grade fissure vein (GSHG)

Lode Samples for Silver by Exploratory Drilling

1.000 opt Ag, ID: Quartz Lode 029741-D210, Oct 09, 2002, pg 13b

0.726 opt Ag, ID: Misc. Sample, 7645-D210, Oct 26, 2002, pg 13b

LM Cut 1, Hole 2:

0.98 opt Ag, ID: 00-04, pg 8a

0.30 opt Ag, ID: 08-12, pg 8a

0.51 opt Ag, ID: 12-16, pg 8a

0.44 opt Ag, ID: 20-24, pg 8a

0.30 opt Ag, ID: 24-28, pg 8a

0.24 opt Ag, ID: 40-44, pg 8a

Gold and Silver Assay by Exploratory Drilling

0.003 - 0.2 opt Au & Ag: 475 ft – 675 ft deep, JA Drill Program. The sulfide silver-gold ore continues to claims in the southwest. Ores in these mines are very rich in silver-gold values (see samples), pg 5f with excerpt of geological and grading table from Owner’s Drill Log.

Proposed Drill Program for 2009 could be expanded into 200k-250k opt Au resource for the shallower, upper zone of disseminated deposit.

-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~-~

II. Offer Amendments - Nevada Gold Mine Property (PROP)

I. Acronyms

SELR: Current owner as described in the Offering Booklet for the PROP.

PROP: The gold-silver mine as described in the 2009 Offering Booklet.

BUYR: Buyer(s) or group of investors for the PROP.

USFS: United States Forest Service.

BLM: United States Bureau of Land Management.

United States: The federal government for the United States of America aka U.S., USA.

GOV: Any government agency with jurisdiction concerning the PROP.

GOV-REQ: GOV Requirements such as but not limited to: rules, regulations, policy, law, and/or agreements etc. Such items are to be disclosed in advance of sale.

PUB: The Public.

CTRL: Control such as but not limited to: Own, Share, Partnership, Shareholder, Time-share, Fractal Ownership, Lease, Rent, Manage, other forms of participation, whether in whole or part, whether directly or indirectly through other entities.

BIZ-ERA: Era of business operation whether current, pending, tentative, proposed, future, yet to be determined, including further development or another use for the PROP.

OP: The business Operations on the PROP such as mining.

II. Ownership

The SELR desires to maintain a 20% ownership in the PROP so as to receive partnership profit benefits for operating the PROP. SELR wants investors to have 80% ownership of the PROP and OP.

Advantages to retain SELR in ownership:

SELR prefers to create the team that will run the operations of mining, transportation, milling, smelting, refining. SELR has 30 years experience with mining in the locale.

SELR has many years of experience and maintained a high degree of trust, recognition and favor with persons public, private, corporate and government in Nevada and the USA.

SELR can also assist the sales of mining products.

SELR manages OP to comply with GOV-REQ. SELR knows GOV-REQ.

If a BUYR desires to buy 100% of the PROP, then there will be strict, irrevocable stipulations in agreements that require:

1. BUYR assume full liability for satisfaction of adhering to compliance to jurisdiction by GOV.

2. Indemnify and hold harmless SELR from any infraction or violation of GOV-REQ caused by operations of/to/for the PROP.

3. BUYR will assume the existing bond with GOV for the PROP and adjacent vicinity.

4. BUYR will pay for all costs to restore damage to PROP or any land affected by operations on/for/to PROP.

5. BUYR will pay for all costs to protect and if necessary to restore SELR reputation with GOV.

6. BUYR will pay for all costs to protect and if necessary to restore SELR reputation with PUB.

7. The current SELR does not want to sell property to anyone who is prone to transgress items 1&2 in this section, since the SELR will CTRL other areas in the mining district for a life-long term and wants good neighbors for good business during a long term.

8. The SELR prefers that BUYR is a private business entity who will participate with him in the operation. The SELR does not want to sell PROP to a mining corporation, nor public corporation.

Final agreement between SELR and BUYR shall be created by the SELR’s attorney.

III. Service Fees to Promoters and Facilitators for the Sales of the PROP

- 3% of Gross Sale of PROP to parties representing the BUYR (BUYR-REP).

- 3% of Gross Sale of PROP to party representing the SELR in a Limited manner (LREP).

- Ancillary Fees, facilitator services such as for personnel required by Law to transact a sale of PROP such as but not necessarily a Real Estate Broker, Escrow Agent, such fee(s) will be split evenly between parties in the transaction(s) unless there are norm standards where such and such fee is paid by only one party. Ancillary Agents shall be researched, discussed and approved by all parties before an Ancillary Agent is granted permission to commence and complete their work as required by GOV.

GOV-REQ are to be made known to all parties of this agreement with ample time to read and understand GOV-REQ before decision, signature and/or payment is required of party responsible to render decision, signature and/or payment. A general list of such items and where to find the text of such requirements should be made known well in advance of the legal sales agreement rendered by legal representatives such as attorneys and real estate brokers.

- Advisor, Attorney, Legal, Counselor, Assistance, Consultant fees are paid by the parties that need or want those services; such fees are not required to be shared by other parties in this agreement.

SELLING AT 10% OF RESOURCE ESTIMATE - GOLD & SILVER MINING PROPERTY & FOLLOW VEIN IN SOME NEIGHBOR PROPERTIES, PROJECT GOALS

PROJECT GOALS

Low Overhead Basis - anticipate US$2m to start production: Dig out the high grade au-ag (HGGS) outcrop to 150 feet deep with bulldozer, then tunnel upto 8'W x 12'H for length of HGGS in property for 2-3 years during which make plans to excavate the upper zone of dissemimated deposit by open pit to heap-leach to mill. At midpoint, approx 1.5 years, consider if it is best to dig open pit down to lower zone of HGGS that has an approx bottom of 620 ft deep that would include both zones upper and lower, disseminated and HGGS in one operation of open pit.

The first year of operation would also include careful analysis by SELR-OP with exploratory drilling and experimental milling-metallurgy for approx 6 months to best understand the mineralogy and how to liberate in the most economical manner the precious metals of gold and silver plus mercury.

The sale of this offer is based on the 159koz+ of gold resource by SELR exploratory drilling prgrams further described in further in this blog and emails with attachments. The 159koz+ Au resource is the basis for beginning the operation to discover what is the value of the HGGS. SELR believes the HGGS could produce gold, silver and mercury significantly in excess of the valuation for the 159koz+ Au.

Existing bond with GOV is for 400-500 thousand US$. As production increases so will the price of bonding. Prior to commencing production of the upper zone, a bond for US$1 million paid in cash is needed for the heap-leach operation of the disseminated deposit, approx 250-200 deep with surface outcrops,

SELR's mill is already bonded.

HGGS processing circuit is different and separate from disseminated deposit:

Wash Plant, sulfides go to a gravity and flotation separators.

Crystals of gold and mercury have a higher value than the components, thereby separate processing.

SELR desires to do business only with BUYR that will perform.

Earnest money will be handled by the SELR's mining attorney.

Developing the adjacent 16 mile length by 1.5 mile width (8,000 acres) in the Mining District controlled by the SELR may take 17 years. SELR is wanting the investors of the initial operation to continue in successive operations of what may exploit several bonanzas. Hence the SELR wants Good Neighbors for future Joint Venture Projects in the local trend.

Percentage Buy-Ins Available + 3 More Mines

6 people invest 1M + 3 people invest 1.5M + 1 person .7m = 11.2M total (80% available for Buy-In). (Basic concept for Mine No. 1 in blog below.)

3 parties invest 3M + 1 party invests 2.7M = 11.2 total Buy-In

11 parties invest 1M = 11M (good enough)

2 party invests 4M + 1 invests 3.2M = 11.2M

Other combinations are possible. Please contact me if you want to be on a list to be in the investment group {email near end of blog}.

3 more mines are available for percentages of buy-in.

2. 500 feet away from a very famous historic mine another deposit was found in April 2009. Testing says the deposit is substantial. Max investment is $15M (owner retains the other 50%).

Maybe you can find 1-5 people wanting to invest 1m or more for a percentage of the 50%.

3. Another mine is appox 1 mile from the new investment above. The history of the neighborhood in the district is well known. Please sign a Confidentiality and Non-Compete Agreement so that I can tell you the details and then you can speak with the land owner.

4. The third newly available is approx 7 miles north of the first one listed in the blog below. It has an intercept with 8 OPT Au. Intercepts are typically a 5 or 10 foot vertical section from the assay of a drill hole. Check this webpage for updates every 1-2 weeks.

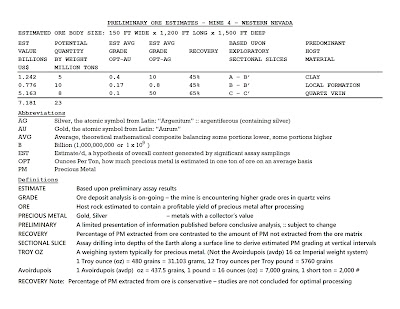

NV SILVER & GOLD MINE STARTING PRODUCTION SOON

PRODUCTION TO START APPROX. FEBRUARY 2010.

ORE IS SITTING IN RE-TIMBERED ADIT.

FULLY PERMITTED.

INVESTMENTS OF 1M & HIGHER WILL BE CONSIDERED.

0.17% ( 0.0017 ) PARTNERSHIP COST COMPARED TO ESTIMATED YIELD OF INFERRED RESOURCE

( 12.245M total partnership TO 7.181B inferred resource)

as related to MID 2009 spot .

300 : 1 ESTIMATED R.O.I.

FOR INFERRED RESOURCE.

10% BUY-IN IS APPROX..... 1.2M

49% BUY-IN IS APPROX..... 6.0M

MINE Co. WILL RETAIN 51%.

24 YEAR+ MINING COMPANY TO OPERATE THE MINE.

OWNER IS AN EXPERIENCED, PRIVATE CORPORATION MINING COMPANY,

HAS EQUIPMENT AND CREWS,

EXPLORED THE DISTRICT FOR YEARS and KNOWS NEVADA.

NO NEED FOR INVESTORS TO BE MINERS.

INVESTORS NEED NOT BE IN THE SAME GROUP.

THIS OFFER NOT AVAILABLE TO PUBLIC CORPORATIONS.

MULTIPLE INDEPENDENT PARTNERS WILL BE CONSIDERED.

CONFIDENTIAL BOOKLET SHARED ONLY WITH QUALIFIED BUYERS.

TOURS ARE AVAILABLE.

Please begin inquiries with email to laneyjc@gmail.com

(Only serious interest need apply...NO PUFFERS...) Eventually we will want to see a letter of credit. If you talk with the mine owner, please tell him you saw Mineral Property's video and webpage.

Resource is BASED ON UNDERGROUND TO SURFACE TABULATIONS OF ORE.

Estimated thru-put of mine: 45 - 100 TONS PER 1-SHIFT DAY.

BUY-INS from 1M to 5M WILL BE CONSIDERED.

MINER WILL RETAIN 51% OWNERSHIP TO OPERATE THE MINE.

OWNER IS AN EXPERIENCED, PRIVATE CORPORATION MINER, HAS EQUIPMENT AND CREWS, EXPLORED THE DISTRICT FOR YEARS and KNOWS NEVADA.

NO NEED FOR INVESTORS TO BE MINERS.

INVESTORS NEED NOT BE IN THE SAME GROUP.

THIS OFFER NOT AVAILABLE TO PUBLIC CORPORATIONS.

MULTIPLE INDEPENDENT PARTNERS WILL BE CONSIDERED.

CONFIDENTIAL BOOKLET SHARED ONLY WITH QUALIFIED BUYERS.

TOURS ARE AVAILABLE.

If you talk with the mine owner, please tell him you saw Mineral Property's video and webpage.

......................

Location of Mines, Mining Company and Miner's Prospecti available after signing an agreement with Mineral Property.

Videos, photos of specimens and locale, Assay Results, Whys & Wherefores, continune for a number of pages after this section. The Mining Co. collected properties for several decades. If you were in such a position would you not also think it wise to sell investments when price of Gold has been increasing since December 2008?

Consider purchasing a portion of a gold and silver mine, whether it is the total buy-in or percentage thereof for any of the following:

Gold Mine No.1 total buy-in is 11.2M (80% of whole, Miner retains 20% and operates). Miner anticipates fully permited in 6 months. Mine Co. currently about to drill 3 assay holes in the high grade vein outcrop.

Gold Mine No.2 is 15M (49% of whole, Miner retains 51% and operates)

Miner anticipates fully permited in 6 months. Soon will commence tight drilling pattern to create a Reserve. It is 600 feet away and close to the surface from a prosperous high grade deposit.

Gold Mine No.3 MUST SEE THE BOOKLET: 7 OPT-Au at water level 120 ft deep, 8 OPT-Au is another target elsewhere, 132 OPT-Au is the Nugget Pocket. It is in central NV. Investment offer has yet to be created.

Gold Mine No.4

(49% of whole, Miner retains 51% and operates)

It is an Inferred Resource

Miner anticipates fully permited in 3 months. "They ore is already in the tunnel." It may be the first mine to harvest as it is ready and easier than the others.

Mine Co. will have a mill in operation near No.3.

Please check this blog for additional information approx every two weeks. There are more videos, photos and assay results yet to post.

If investment is a percentage less than the total partnership

a. For example, 80% for Gold Mine No.1, each party could have 15%:

__ 0.15 x 11.2 m = 1.68 m each.

b. if 17%: 0.17 x 11.2 m = 1.9 m each for 4.7 people

__ (So one or more people have a little more or a little less to make 4 or 5 partners)

c. 18% $2m ea for 4.44 parties

d. Using round numbers

2.0m each x 5 = 10.0m (17.86% max each partner)

1.2m for 1 = 1.2m (6 total partners + MERI)

========================

80% of Gold Mine No.1 = 11.2m

1.5m each x 7 = 10.5 (13.39% max each partner)

0.7m for 1 = 0.7m (8 total partners + MERI)

========================

80% of Gold Mine No.1 = 11.2m

Realistically a range for 6 to 11 partners.

If 11 different partners, then each contributes approx 1m.

........

At end of next video is a geology map depicting a fissure vein where there is a high grade gold and silver vein deposit.